The study analyzed over 15,000 SKUs across the four giants of U.S. retail: Amazon, Target, Walmart, and Ulta. By aggregating fragmented signals from pricing architecture to review volume, the research provided a stable, high-definition snapshot of how different supplement formats are represented and, more importantly, how they are consumed. The findings suggest that while the industry is looking in one direction, the high-value consumer has already moved in another.

Access the full report HERE

The Signal in the Noise: Engagement and Pricing Power

When the data from these 15,000 SKUs was mapped, one trend stood out above all others: the undeniable dominance of liquid formats in the eyes of the consumer.

While the market is flooded with traditional “dry” formats, the research found that liquid formats consistently generate the highest review counts per SKU. This metric is a critical indicator of engagement, where liquids are being purchased and integrated into daily rituals, and showing consumers feel compelled to talk about. Even in retail environments where liquid options are scarce, those that do exist drive significantly more active feedback and repeat interest than their tablet or capsule counterparts.

Furthermore, the study showed a significant consumers’ willingness to pay (WTP) for liquids. On platforms like Ulta, where beauty outcomes drive the purchase, liquid sachets command premium daily-dose pricing. Consumers are signaling that they don’t view liquids as a commodity supplement, but as a high-value beauty ritual.

The Unmet Demand

The most striking revelation of the analysis lies in the supply-demand gap. Despite their high performance, liquids represent a mere 8–10% of total category assortments. However, when modeling revenue power based on engagement and pricing signals, liquids generate 3–4 times more revenue share than their current shelf presence would suggest.

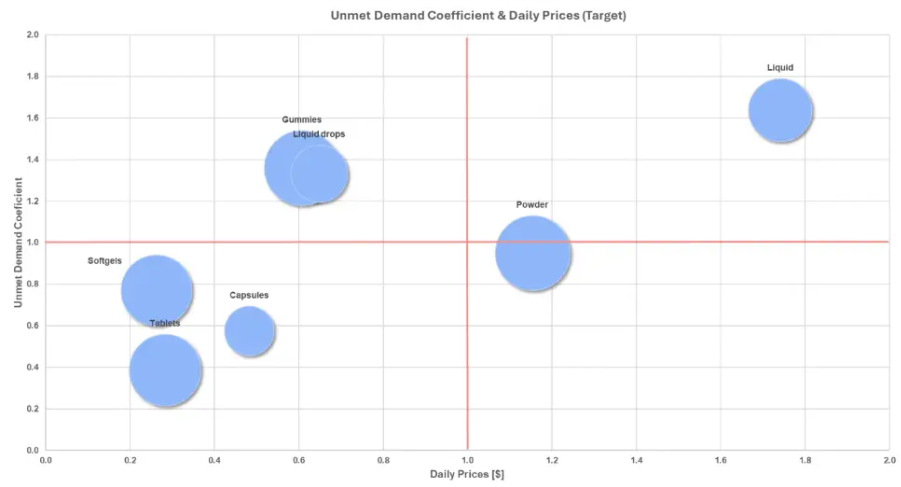

When the research plotted formats on a matrix of unmet demand vs. willingness to pay, the results were exclusive: only liquid formats landed in the coveted top-right quadrant. While gummies and pills cluster in oversupplied or low-value zones, the liquid oligopoly remains a wide-open commercial opportunity.

The data is clear: the most significant commercial opportunity in the beauty-from-within sector is currently the most undersupplied. Liquid formats have surpassed a trend to become the “top-right” format, combining high consumer desire with a high willingness to pay. For brands and retailers, the results of this analysis show that the path to capturing the next generation of loyal, high-margin consumers is through the liquid ritual.

The industry has reached a tipping point where supply must finally catch up to the consumer’s move toward efficacy and experience.

To access the full data visualizations and in-depth findings, visit website here: The Largest Undersupplied Opportunity in Beauty